5 Reasons Why RenRen Will Never Be a Facebook Equivalent

RenRen, a Chinese social network, just had a very successful IPO that raised $743 million for the company on shares priced at $14 (the high end of what many analysts anticipated). Currently, the stock is trading at $16.76 per share, giving the company a valuation of $6.5 billion on revenue of $67.5 million in 2010 – up 64% from 2009 revenues.

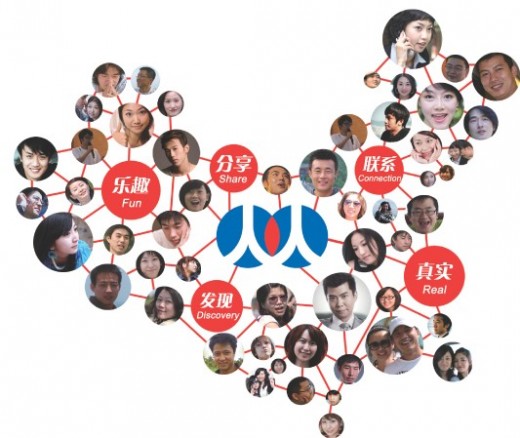

There’s certainly value in the network, but we have to go against the many media outlets who’ve promoted RenRen as “the Chinese Facebook.” It’s not.

Fortune notes some of RenRen’s similarities to Facebook: a social network that started by targeting college students before expanding to everyone, members using their real identities to connect with people they know, a platform for app developers, popular social games, a Connect system with partner websites. There are definitely a lot of similarities, but it’s the differences that account for why RenRen =/= Facebook.

1. Facebook is a big deal outside of the US, RenRen is only big in China

And according to their mission statement

“we aim to define social networking experience and to revolutionize the way that people in China connect, communicate, entertain and shop”

(emphasis, ours) they have no ambitions to change that. China is obviously a good market to be number one in, but so is the US. If Facebook had only focused on growth in the US, they wouldn’t be anywhere near where they are today. Facebook is Facebook because they’re the number one social network in the UK, in France, in Germany, in Canada and many more countries. Sure, there are plenty of countries where Facebook isn’t the top social network – notably Brazil, South Korea and Japan.

But as lucrative as the Chinese market is – and it’s certainly lucrative, being number one in one country just doesn’t equal being number one in 20 (sizable) countries.

2. When it comes to active users, there’s not a clear leader in China

RenRen claims 117 million registered users, but of that only 31 million are active. Percentage wise, that’s slightly more than 1/4th of registered users. No social network is immune to abandoned accounts, but worldwide Facebook claims more than 500 million active users, with 50% logging in daily. At an advertising event in February of this year, Facebook’s head of US Agency Relations broke out some country specific numbers. In the US (Facebook’s home country), there are 149 million active American users, 70% of whom log on daily. {TechCrunch}

Since Facebook doesn’t release registered user numbers (at over 500 million active users, it’s kind of  unnecessary) there’s no definitive figure to compare that with, but Google’s ad planning tool estimates put the number of absolute unique US users to Facebook in March 2011 at 190 million. If we assume all of those users have a Facebook account, that would mean almost 80% of Facebook’s US users are active, and 55% of their total registered user base – not just those who are active – visit the site every day.

RenRen’s active user numbers aren’t close. Add to that, even though analysts say competitors like 51.com are declining, they still maintain an equal or higher number of active Chinese internet users. {SAI/BusinessInsider} So RenRen isn’t exactly losing the fight when it comes to Chinese social networks, but there’s a way to go before they’re declared the winner.

3. Facebook is an internet presence outside Facebook

For a while, some people saw Facebook as the new AOL: a walled garden service that would eventually crash as people began to decentralize and move to sites on the open web. Then Facebook released widgets that allowed for the easy addition of Facebook social features to almost any site on the open web. Almost overnight, it made Facebook a force beyond Facebook.

The ‘Like’ button is officially a year old as of April 21st, and 10,000 sites are using it. RenRen Connect, which launched in October 2009, has 600 partner sites.

It’s not an apples to apples comparison, but probably one of the clearer examples of why our first two points matter.

4. User growth is beginning to plateau

RenRen is still growing, but percentage wise, user and revenue growth is slowing. {BusinessInsider} Facebook’s overall percentage growth may not be as rapid as it was in the past few years, but that’s because it’s pretty hard to keep up 100% year over year growth in every market when you have 500 million active users.

5. There is no RenRen ecosystem

Part of the reason Facebook has been able to raise so much money at eye-popping valuations is the fact that it’s an ecosystem that has the power to not only create revenue for itself, but cottage industries as well. Sure, Facebook owes some of its popularity to companies like Zynga, who create games and apps that keep people on the site; but Zynga also owes a good part of its multi-million dollar value to Facebook. Then there are companies like NorthSocial and BuddyMedia, who provide brands and companies with tools that help them manage their presence on the site.

Even Twitter, who still hasn’t completely figured out how to capitalize on the value it’s creating, has managed to create an ecosystem that other companies can be built on.

While Chinese game developers have had hits, RenRen just isn’t in a position yet to create industries specifically around RenRen.

While it’s highly unlikely that RenRen will ever equal the success of Facebook, it doesn’t have to to be successful. As of April 2010, ComScore estimates that 38% of Chinese internet users visit social networking sites, compared to 81% of US internet users. That means there’s still plenty of room for growth in users and revenue to satisfy investors. Add to that the fact that it’s notoriously difficult for Western consumer tech companies to succeed in China without partnerships, and RenRen certainly has a chance at becoming a significant Chinese internet company. Just don’t compare it to Facebook.